Planning Makes a Difference

Financial planning is about more than assets, investments and net worth. It’s about what you want to do with your money and why. It’s about identifying your concerns, expectations and goals – it’s about how you feel and what you want.

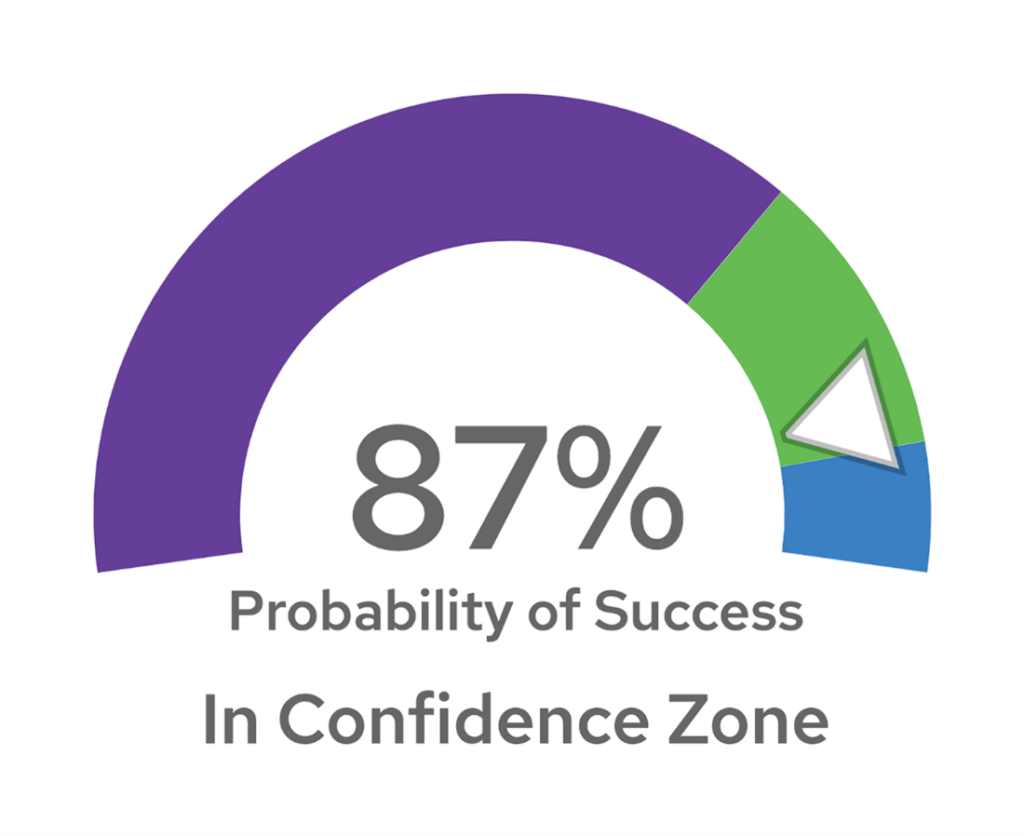

Our advisors help address common fears and concerns such as health care costs, outliving your money and the best time to file for Social Security benefits. We help our clients with tax-efficient investing and wealth transfer. Our confidence meter helps you gauge how likely you are to reach your goals and whether you are on track.

5 reasons why you should work with a financial professional to create a retirement plan:

- Focus on goals in retirement and how you will pay for them.

- Address your concerns and expectations for retirement.

- Identify things that could pose a threat to your retirement and manage them.

- Feel more educate, confident and in control of your financial future.

- To help you navigate the complexity of financially moving into retirement.